Bitcoin or Bit-con? Talking blockchain with Hazel Henderson

Hazel Henderson is a multi-award-winning futurist and evolutionary economist, and the founder-president of Ethical Markets Media, an independent media company promoting the emergence of a sustainable, green, more ethical and just economy worldwide.

After the publication of her recent article "Money is not wealth: cryptos vs. fiats" garnered significant attention worldwide, the GEC caught up with Hazel to get her take on blockchain, bitcoin, and the potential for cryptocurrency technology in the green economy.

GEC: Hazel, from what you’ve already written I think it’s fair to say you’re not convinced by all the hype around Bitcoin. Could you just outline why that is?

Hazel: As I’ve pointed out, money is not wealth. In other words, bitcoin, like most cryptos and many fiat currencies, has no intrinsic value. They are just information, a metric like inches or centimetres, that can be used to track real wealth: the productive activities of humans interacting with natural resources and ecosystems.

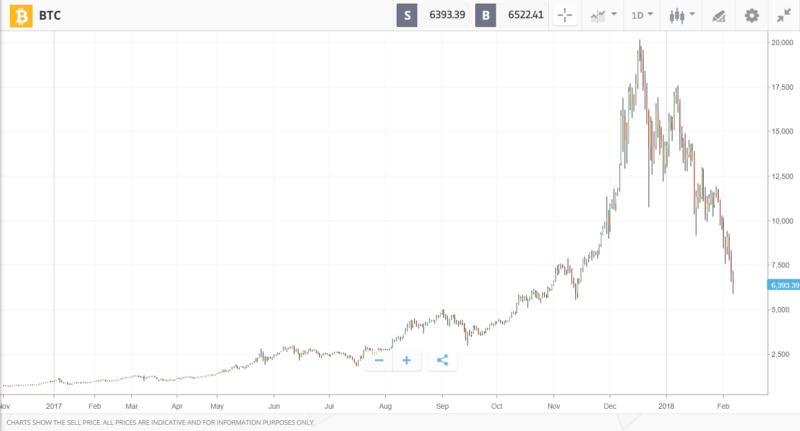

If such money units (cryptos or fiats) are backed by real world goods and services, not inflated or manipulated, then they can be an honest medium of exchange. But we are learning from the bitcoin fraud that money itself, of whatever kind – whether dollars, pounds, or bitcoin – is not a reliable store of value. Speculative frenzies can artificially drive up the price of a currency, but when such bubbles burst that inflated value disappears in an instant!

That’s why most of the scrip currencies issued in local communities after the Great Depression had to be spent into the community to restore local prosperity, to strengthen the link between the currency and real goods and services. Likewise, many of them had to be stamped every month to remain in circulation and would expire after a certain date – to prevent hoarding.

This horrifies Wall Streeters, since their game is to try and make money out of money by dreaming up derivatives or trading secondary instruments with each other. They forget that owning a share of stock does not give you ownership over a living corporation or its employees! A stock certificate is simply a tradable contract whose value changes daily in the market.

So maybe Bitcoin is a bust – but what about other cryptocurrencies? Haven’t some people argued that they could be the new “green money” that enables the transition to a new green economy?

Yes! As new blockchain platforms evolve beyond the inefficient bitcoin system, it’s becoming possible to design cryptos that can qualify as “green money”. But these must be backed 100% by real world valuable resources or services, rather than notional units, for example: cryptos based on carbon credits or offsets, which are often fraudulent and subject to gaming, as we know.

We at Ethical Markets partner with the best crypto we could find backed by real resources: Solar Coin (www.solarcoin.org), which is a rewards currency managed by a non-profit foundation and founded by a former Wall Streeter, Nicholas Gogerty who quit to learn biology and ecology (see his “The Nature of Value”, Columbia University Press, 2012).

Unlike other cryptos created via energy-intensive algorithmic mining, Solar Coins can be earned by anyone who produces energy from the sun, either with home-installed solar panels or many larger installations including the first electric power company in Europe which recently claimed its verified Solar Coins. This helps incentivise people to install more solar and produce more renewable energy!

“ The late global ecologist/activist Maurice Strong, who chaired the UN Earth Summits, used to say - we can’t deal with the eco problem until we deal with the ego problem!”

You make the point in “Money is Not Wealth” that trust in regular fiat currencies is declining. If that’s the case, then aren’t cryptocurrencies a potential solution? After all, they have a collaborative, global, trusted transaction record hard-wired into the system!

This is the hope of those using their dollars, pounds, euros and yen to buy cryptos like bitcoin. They tend to have libertarian leanings, or they just don’t trust any governments. But, so far, their faith in cryptos and the security supposedly provided by distributed ledger blockchain platforms, has been misplaced or they have been betrayed. Not only are cryptos (of which there are about 1,500 so far, traded on new and largely unregulated virtual exchanges) volatile in the extreme, but they have also been hacked, stolen, and manipulated.

For some, the lack of government oversight is a strength of cryptos, but in practice this lawless environment just makes it easier for people to be ripped off and prices to be artificially manipulated. Witness all the media reports and ads for cryptos: they show pictures of shiny gold-coloured coins, but these don’t exist. All cryptos are just strings of computer code running on software programs, and the electronic keys and wallets in which cryptos are stored are also subject to hacking, theft or loss. Bitcoin mining alone now consumes more electricity than the annual consumption of New Zealand! Remember: all these systems, like the internet itself, are based on electricity - pull the plug, or if the power goes down or if the power company is hit by a cyber attack …and it all disappears.

What about blockchain technology? Might that not have useful applications in the real world – with greater transparency and trust encoded into digital record-keeping?

Blockchains are proving useful in many applications, but are not the magic bullet often touted. Blockchains offer verifiable distributed ledgers for contracts and trading value with peer-to-peer security without middlemen. The only implicit rules are those imposed by their various issuers and providing companies. Blockchain platforms are mostly being adopted by traditional big banks, insurance companies and stock exchanges to improve the efficiency and profitability of their existing operations – “paving old cowpaths,” as our IT friends say.

So we need to keep our eyes open and our wits about us! Blockchain technologies are constantly evolving, like the Ethereum blockchain system, on which Solar Coin is currently based. But we should remain agnostic regarding which blockchain platforms to use, which are most energy-efficient, which are most ecologically sustainable and ethically managed.

We partner with another firm, EverLedger, which uses its blockchain to verify the provenance and quality of mined diamonds. This kind of record-keeping can help identify blood diamonds, track the energy emissions and pollution of different mines and companies, and prevent cartel manipulation of prices.

Some years ago, we joined the global campaign against conflict gems and “blood diamonds” by inaugurating our global EthicMark® GEMS standard, which certifies only gems NOT mined from Mother Earth and therefore conflict-free, environmentally friendly and much less expensive (see www.ethicmarkgems.com and my article there “Beyond Bloodstained Gems: New Science and Standards”) since such lab-created gems chemically indistinguishable from those mined are now a growing craft industry of SMEs worldwide. Blockchain techs like EverLedger can play a vital role in helping bring transparency and accountability to the global conflict diamond marketplace.

Other than the bitcoin bubble, why do you think that cryptos and blockchain are getting so much attention and hype at the moment? What’s driving that – and do you think it’ll change any time soon?

All the hype comes from the same greed-driven capitalistic culture that Silicon Valley and IT companies inherited from Wall Street. They want to get “rich” -- whatever that means to them. It’s all about ego needs and the drive for power and status. I remember the late global ecologist/activist Maurice Strong, who chaired the UN Earth Summits, used to say, “We can’t deal with the eco problem until we deal with the ego problem!”

Trading itself, as I have mentioned in our Green Transition Scoreboard® is an addiction, similar to gambling and visible on trading floors on many stock exchanges. Biologist John Coates took cheek swabs of traders on Canary Wharf and found elevated levels of testosterone, known to lead to excessive risk-taking, all documented in his “The Hour between Dog and Wolf” (2012).

Hazel Henderson, Ethical Markets Media

Photo: Andre Francois on Unsplash