Inclusive green futures need wealth taxes

Tax isn’t technical, its fundamental to economic justice

We’re nearly two-thirds of the way through 2024 – the “year of elections”, when democracy itself is supposedly on the ballot – and for us, three things have become clear.

Firstly, the climate crisis is accelerating. Secondly, mainstream political parties are flailing, as inflation, polarisation and extremism destabilise the centre ground. And thirdly, voters are open to more radical solutions to address these issues – but politicians are failing to seize the opportunity for transformative solutions.

“ Wealth taxes are not just a fiscal tool; they are a symbol of our collective commitment to a fairer, greener future.”

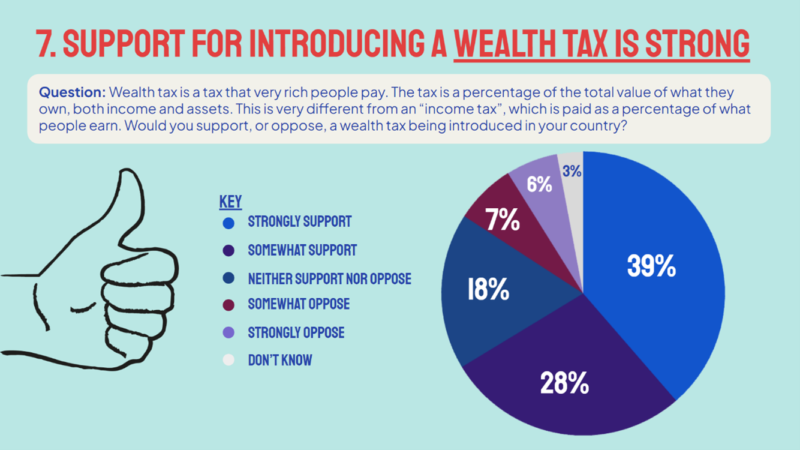

In this volatile space, the idea of wealth taxes – a tax for the very rich, measured against the total value of assets, including land, property, stocks, savings and securities, not just income – is rapidly gaining ground. A recent survey found that over two-thirds of respondents supported introducing a wealth tax, with only 13% opposing. Indeed, failing to support wealth taxes increasingly seems to be a luxury that only the rich can afford.

Why a Wealth Tax?

- Tackling Inequality: The concentration of wealth in the hands of a few has reached unprecedented levels. This disparity undermines social cohesion and economic stability. A wealth tax would help redistribute resources, ensuring that the wealthiest contribute their fair share to society.

- Funding Green Transitions: The transition to a green economy requires an estimated $3.5bn significant investment. From renewable energy infrastructure to sustainable agriculture and beyond, a wealth tax can generate the necessary funds to drive this transformation.

- Promoting Inclusivity: An inclusive economy is one where everyone has the opportunity to thrive. Revenue from a wealth tax can be channelled into education, healthcare, and other public services, creating a more level playing field for people within countries and across countries.

An idea whose time is coming (but could come quicker)

Recent research from Money Talks sets out the best advocacy strategies for politicians, civil society organisations and progressives to boost support for wealth taxes. The primary lever is clear communication - on the benefits of wealth taxes, who pays and who will benefit. The research recommends:

- Being specific about who is being taxed - what is the level of wealth that is being targeted? Will there be exemptions? Many more respondents supported a tax when it was framed as only targeting the top 5-10%, ‘billionaires’ and / or the ‘super-rich’.

- Being clear that those most responsible for climate change are responsible for generating the funds required to address it. Key to this messaging will be raising awareness of the disproportionate carbon emissions of the very wealthy.

- Communicating tax as a way to make society fairer and increase spending on public services, which can drastically increase support.

The G20 and UN Tax Convention: A New Dawn

Wealth taxes are not just a fiscal tool; they are a symbol of our collective commitment to a fairer, greener future. And they’re not just supported by ordinary people; governments and officials are signing up too.

Just this week, Finance ministers from G20 countries committed to taxing "ultra-high-net-worth individuals", reflecting a growing consensus among many economies that progressive taxation is pivotal in fostering inclusive growth and addressing the climate crisis.

The G20 declaration also outlines practical steps for the introduction of wealth taxes, emphasizing the need for international cooperation and harmonization of tax policies. A global framework to prevent tax evasion by ensuring the exchange of financial information between countries and the development of robust mechanisms to assess and collect wealth taxes were proposed.

While an important first, there will be trouble ahead. Policy sophistication, political savvy and extensive stakeholder engagements to build broad based support for taxation policies will be needed to overcome political resistance, administrative complexities and unintended consequences of policy design.

Meanwhile at the UN, tax convention discussions reflect both the challenges inherent in transformative change, but also the possibility of discipline, solidarity and commitment to tackling this issue. Achieving consensus among member states with varying economic interests and tax systems will be challenging; the differing agendas of developed and emerging nations is already creating friction during negotiations, as each bloc jostles to safeguard its interests.

Despite these challenges, the prospects of a united UN tax convention are promising, driven by a growing global consensus on the need for fair and effective international tax systems. There is increasing recognition that tax evasion and avoidance by multinational corporations undermines global economic stability and equity.

The UN's involvement brings a level of legitimacy and inclusivity to the discussions, and when combined with the evolving geopolitical landscape, creates the opportunity for progressive change. But, like any major international policy push, it remains beholden to the whims of domestic politics too; perhaps most importantly, the result of the US presidential election in November. If Donald Trump regains the White House then any multilateral agreement on wealth taxes is dead in the water.

A Promising Pathway

The discussions at the G20 and UN Tax Convention have shown that there is a growing global consensus on the need for systemic change. The wealth tax is not just a fiscal tool; it is a symbol of our collective commitment to a fairer, greener future; where prosperity is shared, the planet is protected, and no one is left behind.

- Jean McLean, GEC